Our experts answer readers’ banking questions and write unbiased product reviews (here’s how we assess banking products). In some cases, we receive a commission from our partners; however, our opinions are our own. Terms apply to offers listed on this page.

If you frequently have your phone within arm’s reach, then you may want to consider banking with an institution that has a strong app.

The best banking apps have easy-to-use interfaces that make it easy to manage your account. With just a few taps, you should be able to view your account balances, deposit checks, and contact customer support. With some apps, you can also do things like see your balance without logging in or track your credit score.

Best Mobile Banking Apps

Ally Spending Account – Brand NameBank of America Advantage Plus Checking Account – Brand NameCapital One 360 Checking® – Brand NameSchwab Bank High Yield Investor Checking® Account – Brand NameChase Total Checking® – Brand NameHuntington Asterisk-Free Checking® Account – Brand NameSynchrony High-Yield Savings Account – Brand Name

These are our top picks for mobile banking apps. If you’re also interested in another useful apps, consider going through our best budgeting apps guide.

With a banking app, you should be able to do basic things you’d normally at a bank — deposit checks, speak with a representative, and see your account balances.

Best Mobile Banking App Reviews

Ally

Through the Ally mobile app you can set up savings or spending buckets that let you save for separate goals, like an “Emergency fund” and “Travel Account.” You can also use the Surprise Savings feature to evaluate how much you can afford to save in your checking account, then automatically transfers extra money into savings up to three times per week.

Ally offers 24/7 live customer support, both over the phone and via chat. You can also find nearby ATM locations while using the app.

Some of our other top picks also have better average scores in the Google Play store.

Bank of America

Bank of America is an excellent national banking option for avid mobile users. The brick-and-mortar bank ranks highest in banking mobile app satisfaction, according to a 2023 J.D. Power Online Banking Satisfaction Study.

The mobile app has numerous security features. For example, the app has a security meter that visually represents how to increase the level of protection in your account. You can also receive mobile app alerts for your account balance, or order to replace your debit card if it is lost.

Keep in mind Bank of America checking and savings accounts have monthly service fees unless you meet certain requirements. If you want bank accounts that do not charge any monthly service fees the best online banks may be more appealing for you.

Capital One

The Capital One mobile app is rated the second highest in mobile app customer satisfaction among national banks, according to a 2023 JD Power Online Banking Satisfaction Study. You can use the bank’s app to deposit checks, track your credit score, or monitor your bank account.

If you’re also set on earning a high interest rate on a bank account, bear in mind that other online banks may have more competitive savings or CD rates right now.

Charles Schwab

Charles Schwab lets you invest, save, and spend in the same app. You can use the app to deposit checks or make lists to help monitor market trends.

Some of our other top picks have better Google Play ratings. You must also invest with Charles Schwab to open a checking account.

Chase

Through the Chase mobile app, you can manage your bank accounts, investments, and credit card/card points. You may track your credit score or deposit checks.

The Chase mobile app allows you to set up automatic savings transfers and create folders for separate savings goals, like “Vacation Fund” or “College Savings.” The mobile app is rated highly in customer satisfaction among national banks, according to a 2023 JD Power Online Banking Satisfaction Study.

While Chase offers strong mobile banking, you’ll need to be mindful of monthly service fees. Most of the accounts have ways to waive fees, but if you would prefer a fee-free bank account you might prefer another bank.

Huntington Bank

Huntington ranks No. 1 in customer satisfaction for a regional bank in the J.D. Power 2023 US Banking Mobile App Satisfaction Study. You can view your account balances without logging in and use the Huntington Heads Up feature to alert you if there is suspicious activity on your account or if you’re close to overdrawing. The app also has mobile check deposit and helps you find nearby ATM and branch locations.

As this is a regional bank, there are only branches in seven US states.

Synchrony

You can your credit cards and bank accounts in the same app. Synchrony also has mobile check deposit and offers tips to help you learn about personal finance and managing your money.

Synchrony doesn’t have a checking account.

Mobile Banking Apps FAQs

What is a banking app?

Most big banking institutions have apps you can download in the Apple or Google Play store. You’ll create a username or password. If you’ve already used online banking on your web browser, the login information is probably the same. The app layout should be similar to the browser layout.

Are banking apps free?

Most banking apps are free when you have an account with the bank. But keep in mind that the accounts themselves could come with some fees.

Some banks charge monthly service fees, unless you qualify to waive them. You could also pay fees for overdraft fees, ATM fees, or foreign transaction fees.

What can I do on a banking app?

At the very least, you should be able to use your banking app to check you account balances, transfer money between your own bank accounts, deposit paper checks with the app’s camera, and find customer service contact information. The top banking apps have even more robust features, such as showing all of your financial information in one place, 24/7 live chat, or automatic savings tools.

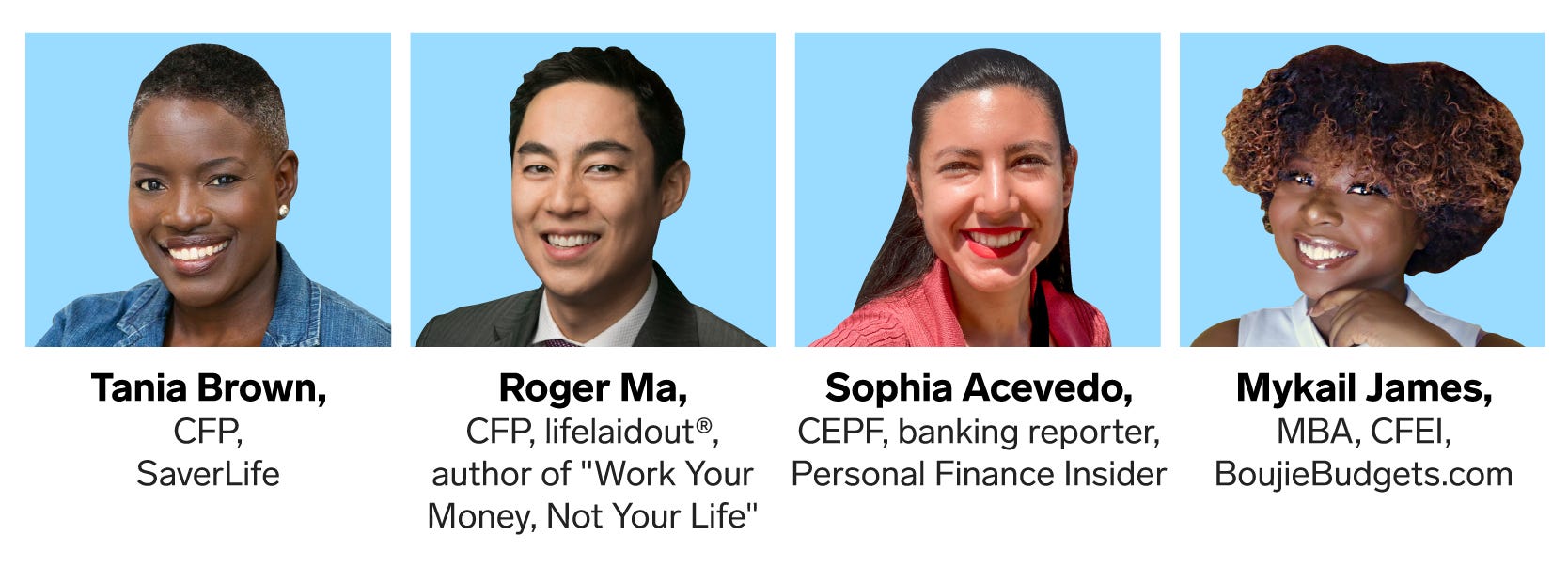

Why You Should Trust Us: Experts’ Advice on the Best Mobile Banking Apps

We consulted banking and financial planning experts to inform these picks and provide their advice on finding the best mobile banking app for your needs.

Insider

Here’s what they had to say about mobile banking apps. (Some text may be lightly edited for clarity.)

What should I look for in a mobile banking app?

Mykail James, MBA, certified financial education instructor, BoujieBudgets.com:

“What kind of push notifications do they offer? Do they offer push notifications for when you swipe your card or if money is deposited into your account? Also, what’s the customer support like? Do they have a 24/7 phone number available? Emails? Do they have a chat box?”

Sophia Acevedo, certified educator in personal finance, banking reporter, Personal Finance Insider:

“I think it’s important for a mobile banking app to have mobile check deposit and features that help you understand your spending. Maybe there’s a feature that can help you save for specific goals or track your cash flow.”

What makes a strong mobile banking app?

Sophia Acevedo, CEPF:

“I think strong mobile app should be as straightforward as possible. You should be able to easily navigate the app and utilize the features without running into any technical difficulties.”

Mykail James, MBA, CFEI:

“One thing that I love for banks to do is when they offer a virtual debit card or credit card. Sometimes I don’t always have a physical card with me. ”

Methodology: How We Chose the Best Mobile Banking Apps

To choose our favorite banking apps, we only looked at apps with at least 5,000 reviews in both the Apple and Google Play stores. Then we narrowed it down to apps with strong average ratings in both stores.

We selected apps for banks that are available in a large chunk of the US. This could mean that a bank has branches in multiple US states, or that it operates online.

Our top picks have competitive products that set them apart from other institutions. For example, a bank may pay high interest rates, have tools to help you save money, or offer early direct deposit.

Where applicable, we also looked at customer satisfaction ratings on J.D. Power surveys.