Our experts answer readers’ credit card questions and write unbiased product reviews (here’s how we assess credit cards). In some cases, we receive a commission from our partners; however, our opinions are our own. Terms apply to offers listed on this page.

The information for the following product(s) has been collected independently by Business Insider: Bank of America® Travel Rewards Credit Card for Students, Chase Freedom Flex℠, U.S. Bank Altitude® Connect Visa Signature® Card. The details for these products have not been reviewed or provided by the issuer.

Whether you’re just dipping your toe into the world of rewards credit cards or you’ve already flown thousands of miles on points alone, we can tell you: There’s a travel credit card for everyone. There’s a card if you’re looking for free flights, if you’re hoping for free hotel stays, or if you’re just doing whatever it takes to realize your dream of an overwater bungalow. There are even no-annual-fee travel credit cards that won’t cost you anything to keep.

Best Travel Credit Cards

Chase Sapphire Preferred® Card: Best overall travel credit cardCapital One VentureOne Rewards Credit Card: Best no-annual-fee card for earning travel milesCapital One Venture Rewards Credit Card: Best travel credit card for beginnersCiti Premier® Card: Best for travel rewards on everyday spendingBank of America® Travel Rewards Credit Card for Students : Best travel card for studentsCapital One Venture X Rewards Credit Card: Best premium travel credit cardAmerican Express® Gold Card: Best for earning travel credit on dining and groceriesChase Sapphire Reserve®: Best premium card for travel bonus categoriesThe Platinum Card® from American Express: Best for luxury travel benefits and airport lounge access

Airline cards and hotel co-branded credit cards can make sense if you travel frequently and are loyal to a particular brand. However, if your main goal is to maximize your rewards earning and have lots of flexibility in using your points, the best credit cards are usually ones that earn transferable points.

Best Travel Credit Cards Comparison

Travel Credit Card Frequently Asked Questions

What is the best travel credit card?

The best travel credit card overall is the Chase Sapphire Preferred® Card, but the best card for your particular situation will depend on what benefits you care about the most, as well as how you feel about paying a high annual fee.

We’d recommend opening a travel card that earns Amex or Chase points, because these are among the easiest rewards to redeem and you have various travel partners to utilize. But if you’ve investigated your options and are confident that you can get value out of their rewards, credit cards that earn Capital One miles or Citi ThankYou points can make sense as well.

What are the different types of travel credit cards?

There are two main types of travel credit cards: Cards that earn transferable points, and airline/hotel co-branded credit cards. Transferable points currencies include Amex Membership Rewards points, Capital One miles, and Chase Ultimate Rewards points. Airline credit cards and hotel credit cards earn points or miles within a respective hotel or airline program; you don’t have the option to redeem your rewards with a wide variety of travel partners (or if you do, the transfer ratio usually isn’t great).

How do I pick a travel credit card?

To pick the right travel credit card for you, you’ll want to evaluate its welcome bonus offer, ease of use, benefits, and annual fee. The best one for you will ideally have a combination of an attractive sign-up bonus, lots of options for earning and redeeming rewards, benefits that save you money, and a low or no annual fee.

Are credit card annual fees worth it?

Travel credit cards with annual fees are worth it if you’re able to get significant value out of their benefits and rewards. Before you apply for a card, make sure you’ll actually use all the features that contribute to the card’s annual fee. For example, if a card offers an annual statement credit of up to $200 toward travel but you can’t use it, you’re probably not getting what you pay for.

How do travel credit cards work?

Travel credit cards work by earning you points (or miles) on every purchase you make, with the goal of helping you earn enough rewards to book free travel. The best travel cards earn points that you can transfer to various airline and hotel partners — like Amex, Chase, or Citi points.

How do I get a free flight?

A great way to work toward getting a free flight is by applying for a travel credit card and earning its welcome bonus offer. Domestic award flights in economy class typically require about 25,000 points, so depending on the welcome bonus offer, you could have enough rewards for a flight right out of the gate.

Travel Credit Card Reviews

The best credit cards offer valuable rewards, easy-to-use benefits, and helpful features like travel coverage. Make sure you can redeem rewards for the travel you want to book before you decide on a travel credit card.

Chase Sapphire Preferred

The Chase Sapphire Reserve® card was previously our pick for the best travel card overall, but it’s since increased its annual fee from $450 to Chase Sapphire Reserve®. While it did add some new perks, it’s become harder to recommend the Reserve to more casual travelers. We now recommend the Chase Sapphire Preferred® Card as the best travel credit card for most people.

Chase Ultimate Rewards® points are some of the easiest rewards to use — and not just for travel. You can redeem them for travel directly through the Chase Ultimate Rewards Travel Portal and get more than 1 cent per point (you get 1.25 cents with the Preferred and 1.5 cents with the Reserve), and Chase’s selection of transfer partners, including United, Hyatt, Marriott, and more, is great for US-based travelers. Cardholders can also use points for statement credits, gift cards, merchandise, and more.

The Chase Sapphire Preferred® Card has a $95 annual fee, and it earns 5 points on travel purchased through Chase Ultimate Rewards, 2 points on all other travel purchases, and 3 points on dining, online grocery purchases (excluding Target, Walmart, and wholesale clubs), and select streaming services. It earns 1 point per dollar on everything else.

The Sapphire Preferred is currently offering Chase Sapphire Preferred® Card – Intro Bonus. Insider pegs Chase points value at 1.8 cents each, on average, making this bonus worth around Chase Sapphire Preferred® Card – Featured Reward Value in travel.

The card stands out for its travel protections. You’ll enjoy insurance if your flight is delayed, if your baggage is delayed or lost, primary rental car insurance, and more if you book eligible travel and meet the benefit requirements.

In addition, the card offers a 10% anniversary points bonus and up to $50 in annual statement credits for hotel purchases made through the Chase Travel Portal.

What the experts love: High welcome bonus offer, earns bonus points on travel, dining, and online grocery purchases, you can redeem points for 1.25 cents apiece for travel or through Chase (a 25% bonus)

What the experts don’t love: Doesn’t offer some of the travel perks you’ll get with competing cards, such as airport lounge access and a statement credit for Global Entry

Read our review: Chase Sapphire Preferred card review

Capital One VentureOne

The Capital One VentureOne Rewards Credit Card is our top choice for a no-annual-fee travel card, and it’s got many of the same perks as its bigger sibling, the Capital One Venture Rewards Credit Card.

New cardholders can earn a respectable Capital One VentureOne Rewards Credit Card (worth at least Capital One VentureOne Rewards Credit Card in travel according to Insider’s valuations). While the card only earns 1.25 miles per dollar on most purchases (plus 5x on hotels and car rentals booked through Capital One Travel), it’s still a compelling choice if an annual fee isn’t for you.

You’ll get the same access to Capital One’s airline and hotel partners as you would with annual-fee cards, and a handful of benefits including car rental insurance***, travel accident insurance***, and extended warranty***. This is also a solid pick if you’re looking for a zero-interest credit card with a 0% introductory APR offer, because new cardholders receive a Capital One VentureOne Rewards Credit Card, then a Capital One VentureOne Rewards Credit Card APR (Capital One VentureOne Rewards Credit Card – Rates and Fees – Editorial Name Only).

What the experts love: No annual fee, access to transfer partners, generous intro 0% APR offer

What the experts don’t love: Few travel benefits, lower earning rate

Read our review: Capital One VentureOne Rewards card review

Capital One Venture Card

The Capital One Venture Rewards Credit Card is a great “set it and forget it” card, in the sense that you don’t have to worry about various bonus categories for earning rewards. You’ll earn 5 miles per dollar on hotels and rental cars booked through Capital One Travel and 2x miles on all other purchases.

Capital One will launch the new Lifestyle Collection hotel booking program later this year. Venture and Spark Miles cardholders will have access to a curated list of hotels worldwide and receive benefits that include a $50 hotel experience credit, room upgrades when available, and early check-in/late checkout when available.

This card also offers one of the most straightforward ways to redeem rewards for travel: you’re able to use your miles to cover recent travel purchases from your card statement, at a rate of 1 cent per mile.

You also have the option to transfer Capital One miles*** to more than a dozen frequent flyer and hotel loyalty programs, including Air Canada Aeroplan, Etihad Guest, and Singapore Airlines KrisFlyer. Capital One also added new partners including British Airways and Turkish Airlines, and improved the transfer ratio to 1:1 for most partners.

The selection of transfer partners is best suited to someone who wants to travel internationally and who doesn’t mind spending some time researching the best ways to redeem miles with the different frequent flyer program options. But the upside is that you can always use your miles to cover your travel purchases. You also get up to a $100 Global Entry/TSA PreCheck application fee credit.

What the experts love: The ability to use your miles to cover your recent travel expenses; it earns at least 2 miles per dollar on every purchase.

What the experts don’t love: “If you redeem miles for cash back, their value drops in half,” points out Rathner. Benét Wilson, senior editor at The Points Guy, also notes that other cards offer higher rewards on purchases such as travel and dining.

Read our review: Capital One Venture card review

Citi Premier Card

The Citi Premier® Card isn’t as flashy or well-known as some other travel cards, but that doesn’t mean you should overlook it — especially if you spend a lot on its bonus categories. Cardholders earn an impressive 3x points on air travel, gas stations, restaurants, supermarkets, and hotels, and 1 point per dollar on everything else.

Along with a solid welcome bonus offer of Citi Premier® Card (worth Citi Premier® Card based on Insider’s valuations), you’ll receive $100 off a single hotel stay of $500 or more (excluding taxes and fees) booked through thankyou.com once per calendar year.

While it isn’t the best for travel protections, the Citi Premier® Card is the only card currently available to new applicants that unlocks the ability to transfer your ThankYou points to Citi’s full list of airline and hotel partners, including JetBlue, Singapore Airlines, and Wyndham.

What the experts love: Strong rewards earning in useful everyday categories, access to Citi’s transfer partners

What the experts don’t love: Lack of travel protections like car rental insurance, few travel perks compared to similar rewards cards

Read our review: Citi Premier card review

Bank of America Travel Rewards Credit Card for Students

The Bank of America® Travel Rewards Credit Card for Students is a fairly unique offering, as there aren’t many student credit cards specifically geared toward travel. New cardholders can earn Bank of America® Travel Rewards Credit Card for Students. That’s a decent offer for a no-annual-fee card, and the earning structure is simple, too — 1.5x points per dollar on every purchase, with no bonus categories to keep track of.

There’s also a Bank of America® Travel Rewards Credit Card for Students (then a Bank of America® Travel Rewards Credit Card for Students APR) which can be handy if you have big purchases (like textbooks or supplies) you want to pay for over time.

The Bank of America® Travel Rewards Credit Card for Students is a good choice if you prefer a straightforward card without having to worry about award charts or transfer partners. It’s also a safe bet if you want to use it while traveling internationally — it doesn’t charge pesky foreign transaction fees, so you won’t be on the hook for extra charges if you use it overseas.

However, you won’t find many extras — like travel benefits or purchase protections — with this card. If you’re looking for better benefits, be sure to check out our guide to the best student credit cards for all the top options.

What the experts love: Impressive welcome bonus offer for a student credit card, good flat-rate rewards earning

What the experts don’t love: No flashy extra perks or shopping benefits

Read our review: Bank of America Travel Rewards Credit Card for Students review

Capital One Venture X

The Capital One Venture X Rewards Credit Card was unveiled over a year ago. It offers a massive welcome bonus of Capital One Venture X Rewards Credit Card — worth at least Capital One Venture X Rewards Credit Card in travel, based on Insider’s valuation of Capital One miles.

The Capital One Venture X Rewards Credit Card is loaded with premium benefits that can more than offset the Capital One Venture X Rewards Credit Card annual fee — which is lower than other premium travel cards (see rates and fees).

Cardholders receive $300 per year in credits toward travel booked through Capital One, Priority Pass, Plaza Premium, and Capital One airport lounge access (even for authorized users), a 10,000-mile bonus on each account anniversary (worth $100 in travel), and Visa Infinite travel and purchase benefits.

Capital One recently launched its luxury hotel booking program, the Capital One Premier Collection. Capital One Venture X Rewards Credit Card cardholders can access hundreds of premium hotels and resorts worldwide and receive elite-like benefits such as free breakfast, room upgrades, and on-property credits.

As with other cards that earn Capital One miles, you can transfer rewards to over a dozen airline and hotel partners to book award travel, or use miles to book through the Capital One Travel Portal.

What the experts love: Between $300 a year in travel credit and a 10,000-mile bonus on each account anniversary, you can offset the annual fee entirely — and that’s not even considering other benefits like lounge access.

What the experts don’t love: The $300 travel credit is more restrictive than other cards’ — it only applies to travel booked through Capital One.

Read our review: Capital One Venture X Rewards credit card review

Amex Gold

The American Express® Gold Card – Product Name Only is an ideal travel card for anyone who frequently eats out and/or shops at U.S. supermarkets. You’ll earn 4x Amex Membership Rewards points on these purchases (though note the $25,000 calendar year annual cap for U.S. supermarkets; after that, you’ll earn just 1 point per dollar, but that’s a pretty high cap). The card also earns 3x points on flights booked directly with the airlines or through AmexTravel.com, and 1 point per dollar on everything else.

While the $250 annual fee is on the high side, you can offset it thanks to an annual statement credit. You can get up to $120 in annual dining credits**, but it’s divided into up to $10 in credits each month, and the credit only applies at select restaurants and delivery services, including Grubhub, Seamless, Milk Bar, Wine.com, and Goldbelly, and participating Shake Shack locations.

You’ll also get up to $120 Uber Cash ($10 per month) credit each calendar year (this is only applicable to U.S. Eats orders and rides, and the Gold Card needs to be added to the Uber app to receive the Uber Cash benefit).

What the experts love: “4x points on restaurants and at U.S. supermarkets (on up to $25,000 per year, then 1x) is great — usually, a card favors one or the other,” says Rathner. Plus, the card offers monthly dining credits.

What the experts don’t love: Wilson notes that other cards offer similar benefits for a lower annual fee, and Rathner notes that the card’s travel and dining credits come with some important limitations — so read the fine print.

Read our review: Amex Gold card review

Chase Sapphire Reserve

The Chase Sapphire Reserve® has a $550 annual fee, which means it’s not for everybody, but if you’re serious about maximizing your rewards and you travel frequently, it could be worth it. It offers a bonus of Chase Sapphire Reserve®.

Not only do you get up to $300 in statement credits toward travel each year (and Chase has a very generous definition of travel — including everything from airfare to highway tolls), but you also earn 5x total points on air travel and 10x total points on hotels and car rentals purchased through Chase Ultimate Rewards (excluding the $300 travel credit) and 3x points on all other travel and dining. You also get airport lounge access through the Priority Pass network, which has more than 1,300 locations worldwide.

New benefits also include access to Chase Sapphire lounges (including the recently opened Boston Chase Sapphire Lounge and Hong Kong’s Sapphire Lounge, which opened in October 2022) and to the Chase Sapphire Terrace at Austin Airport. You’ll also receive benefits with DoorDash, Gopuff, and Instacart that can save you money on delivery (activation required).

The Chase Sapphire Reserve® is currently offering cardholders two years of complimentary Lyft Pink All Access membership (valued at $199 per year) for member-exclusive pricing, priority pickup, and more (activation required).

When it comes to redeeming points, you can book travel through Chase and get 1.5 cents per point (a 50% bonus over the standard 1-cent-per-point rate), or you can transfer your Chase Ultimate Rewards to travel partners like Hyatt, British Airways, and United.

Plus, like the less-expensive Chase Sapphire Preferred® Card, the Chase Sapphire Reserve® offers some of the best credit card travel insurance around. This includes primary car rental insurance, trip delay insurance, trip cancellation protection, and lost baggage insurance.

What the experts love: Earns 3x points on travel and dining purchases made outside of Chase Ultimate Rewards portal, annual $300 travel credit, points are worth 1.5 cents apiece for travel booked through Chase

What the experts don’t love: “You have to really squeeze every drop of value out of this card to make that jaw-dropping $550 annual fee worth it,” says Sara Rathner, credit card expert at NerdWallet.

Read our review: Chase Sapphire Reserve credit card review

Amex Platinum

The Platinum Card® from American Express has one of the highest rewards card annual fees — The Platinum Card® from American Express — but it can still be well worth it if you can put all of its statement credits and generous welcome bonus offer to use.

You’ll earn 5x points on flights when you book directly through the airline or through American Express Travel (starting January 1, 2021, earn 5x points on up to $500,000 on these purchases per calendar year), which makes the card a great choice for purchasing airfare. The card offers trip cancellation and interruption insurance, plus some of the best purchase protection, so it’s a good option for buying expensive items (and don’t forget to see if you can take advantage of an Amex Offer** for bonus points or cash back).

The The Platinum Card® from American Express offers more airport lounge access than any other personal travel card — in addition to Priority Pass membership**, you get access to Amex Centurion Lounges, Delta Sky Clubs (when you’re flying Delta), and more.

The card’s annual statement credits can go a long way toward offsetting the high annual fee. You get up to $200 in statement credits toward airline incidental fees** like checked bags and inflight purchases; up to $100 each year in credit toward Saks Fifth Avenue purchases**; and up to $200 in annual Uber credits (including Uber Eats)**.

The The Platinum Card® from American Express added a range of valuable benefits, including up to $300 annually in Equinox credits**, $189 per year in credits for CLEAR® Plus membership**, up to $200 per year in credits toward eligible prepaid hotel bookings, up to $240 in annual credits toward eligible digital subscriptions**, a monthly credit for Walmart+ membership**, and up to $300 back for purchasing a SoulCycle At-Home Bike through Equinox+.

Just keep in mind that you’re limited to one designated airline you choose each year in your Amex account for the airline incidental fee credit, and both the Saks and Uber credits are divided into portions. You’ll get up to $50 in statement credits toward Saks purchases from January to June, and another credit of up to $50 for Saks purchases from July to December.

With the Uber credit, you get up to $15 each month, and a $20 bonus in December for a total of $35 that month.

What the experts love: Lots of luxury benefits, including airport lounge access and statement credits with Uber and Saks

What the experts don’t love: $550 annual fee, plus this card doesn’t offer bonus points on very many types of purchases

Read our review: American Express Platinum card review

Other Top Travel Credit Cards We Considered

Our list of the best travel credit cards contains our very top picks, but there are dozens of other travel credit cards out there. Here are some cards that almost made the cut, along with why we opted to leave them off our final list.

Chase Freedom Flex℠ — This no-annual-fee card offers up to 5x points on everyday purchases and comes with a welcome bonus offer of Chase Freedom Flex℠. Although it earns Chase Ultimate Rewards, your points are only worth 1 cent each toward travel unless you also have an annual-fee card (Chase Sapphire Preferred® Card, Chase Sapphire Reserve®, or Ink Business Preferred® Credit Card). Read our Chase Freedom Flex credit card review for all the details.Chase Freedom Unlimited® — Similar to the Flex, this card offers anywhere from 1.5x to 5x points on purchases, but you’ll need one of the three annual-fee Chase cards mentioned above to make the most of your rewards for travel. It’s got a solid welcome offer as well: Chase Freedom Unlimited®. Here’s our Chase Freedom Unlimited review to learn more.Wells Fargo Autograph℠ Card — This Wells Fargo card earns an unlimited 3x points on travel (along with restaurants, gas stations, transit, popular streaming services, and phone plans), and 1x on everything else. That’s a solid rate of return for a Wells Fargo Autograph℠ Card-annual-fee card, and you’ll get a handful of compelling benefits as well. But there are no transfer partners, so you’ll only get 1 cent per point whether you redeem for travel, statement credits, or gift cards. Read our Wells Fargo Autograph credit card review for all the details.Discover it® Miles — Discover’s travel miles-earning card earns 1.5x miles on all purchases (worth 1 cent apiece toward travel or cash back), but it doesn’t offer a traditional welcome bonus. Instead, Discover’s Cashback Match™ program will match all the miles you earn in the first 12 months of account opening — which is compelling for big spenders, but not as helpful if you won’t use the card that often. On the upside, you won’t pay an annual fee or foreign transaction fees. You can find out more in our Discover it Miles review.Bilt Mastercard® — This no-annual-fee card’s unique feature is the ability to earn rewards for paying rent with no added fees — which can translate to lots of points if you’re a renter. The Bilt Rewards program also offers a useful range of airline and hotel transfer partners, including American Airlines and Hyatt. But if you don’t rent, you can do much better with other travel cards. Here’s our Bilt Mastercard card review for the full rundown. U.S. Bank Altitude® Connect Visa Signature® Card — This is a terrific card for travel spending (including gas), offering 4x points on travel and at gas stations, 2x points at grocery stores, grocery delivery, dining, and streaming services, and 1 point per dollar everywhere else. It’s got a generous welcome bonus offer and decent benefits, too, including a Priority Pass membership with four free visits per year, Global Entry/TSA PreCheck application fee credit, travel insurance, and cell phone protection. However, after the first year, an annual fee applies — and there aren’t any opportunities to get outsized value from your points with transfer partners. You can learn more in our US Bank Altitude Connect card review.Bank of America® Travel Rewards credit card— If you want to earn travel rewards without an annual fee, this card is worth considering, although it doesn’t come with much in the way of travel benefits or extra perks. The card becomes a lot more valuable if you’re a Bank of America Preferred Rewards customer, because the points you earn from the card can be worth 25% to 75% more. Read our Bank of America Travel Rewards credit card review to find see if it’s worth it for your situation.

Choose the Best Travel Credit Card for You

While it takes more effort to redeem points or miles compared to cash back, the upside is that you can get much more value for your points compared to simply cashing in your rewards for a statement credit or check at a rate of 1 cent per point.

In fact, it’s possible to receive double, triple, or even more than that amount when you’re strategic about how you redeem your rewards, particularly if you book expensive luxury hotels or first-class flights.

In this guide, we’ve focused mostly on the best travel credit cards that earn transferable points. Transferable points include popular currencies such as:

Amex Membership RewardsChase Ultimate RewardsCiti ThankYou RewardsCapital One miles

You can transfer these points to both airline and hotel partner loyalty programs. You can even redeem your points to offset the cash price of your travel at a flat rate.

Read Insider’s guide to points and miles valuations to find out what your airline miles, hotel points, and credit card rewards are worth. Here’s our methodology for assigning a cash value to your points and miles.

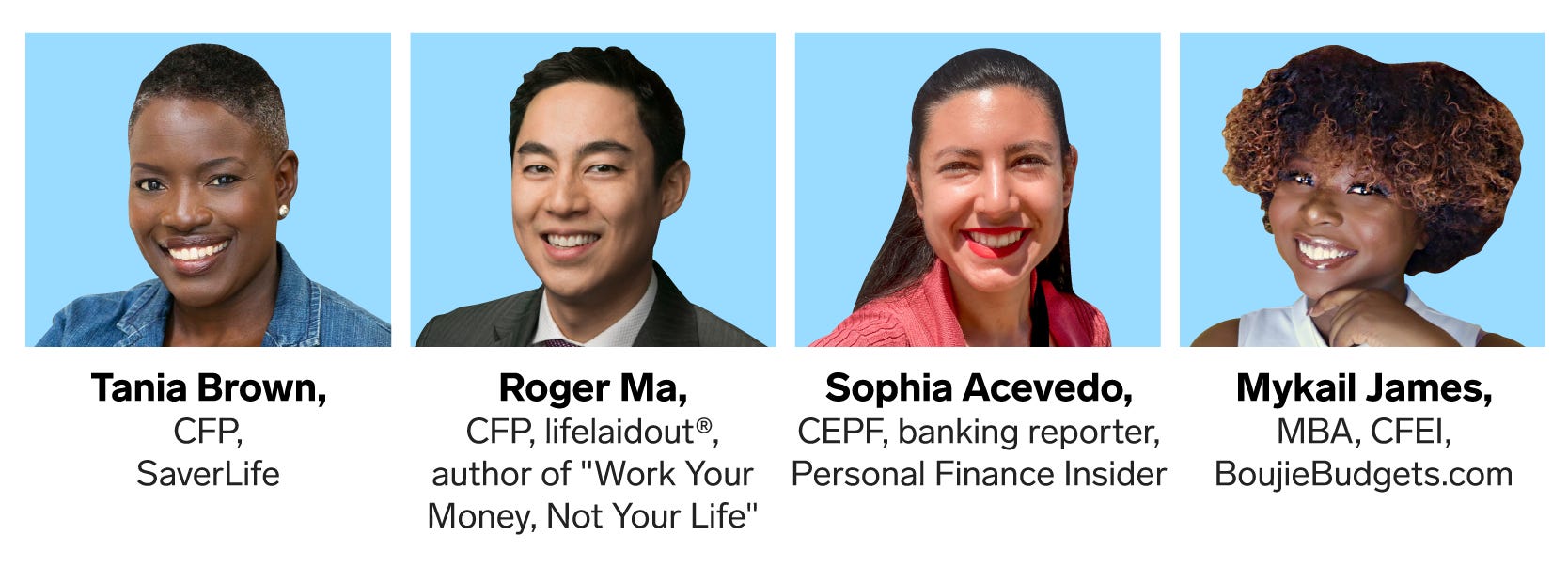

Why You Should Trust Us: Our Expert Panel for the Best Travel Credit Cards

We consulted top credit card experts as well as a certified financial planner for advice on the top travel credit cards. Their input informed our picks for the best cards, and you can find a full transcript of our interviews with each of them at the bottom of this page.

Sara Rathner, travel and credit cards expert at NerdWalletLuis Rosa, certified financial plannerSarah Silbert, deputy editor at Personal Finance InsiderBenét Wilson, former senior editor at The Points Guy

Methodology

Personal Finance Insider evaluated dozens of travel credit cards currently available to new applicants and narrowed down the list to the best options based on the following factors:

Welcome bonus offer— Do new cardholders get a valuable incentive to sign up and meet a minimum spending requirement?Ongoing rewards — How many points or miles do you earn on your purchases?Benefits — Beyond rewards, does the card offer valuable perks such as statement credits for travel, primary car rental insurance, and airport lounge access?Annual fee — Is there an annual fee, and if so, is it affordable or easy to offset with card perks?Overall value — Does the card justify its annual fee by offering useful benefits and valuable rewards, and is it worth it?

Read Insider’s guide to how we rate credit cards for a closer look at our methodology.

The Experts’ Advice on Choosing the Best Travel Card for You

We interviewed a certified financial planner and three credit card and travel experts about what makes a good travel credit card. Their feedback informed our list of cards, and you can find the full text of our interviews below.

What features make a travel credit card good?

Sara Rathner, NerdWallet:

Generous ongoing rewards on common spending categories are something I look for, because a welcome bonus offer, while lucrative, can only get you so far. NerdWallet’s 2019 Travel Credit Card Study found that a 50,000-point bonus can cover about 1.6 flights, depending on where and when you travel. If you want to offset a trip in a more major way, you need opportunities to earn more.

Easy redemptions are also really important. No one wants to navigate a maze of rules and restrictions. Those points are yours, so you should be able to spend them without sweating the details.

Luis Rosa, CFP:

Airport lounge access, a statement credit toward Global Entry or TSA PreCheck, and a significant bonus point incentive during the first couple of months.

Sarah Silbert, Personal Finance Insider:

It needs to offer benefits that are useful for you, so it ultimately depends on how you travel and what perks you value. But a few key things to look for are a high welcome bonus offer, strong bonus rewards in your top spending categories, trip protection such as trip cancellation insurance, and no foreign transaction fees. The best premium credit cards should offer higher-end benefits such as airport lounge access and annual travel credits as well.

Benét Wilson:

They’re a great way to earn rewards that allow you to travel the world for less money — or practically for free. All you have to do is use a travel credit card to buy the same items you’d otherwise buy with cash or a debit card, but make sure you pay it off every month. With some travel credit cards, you can also get great travel perks, from airport lounge access and hotel elite status to free airline companion certificates and discounts or credits on travel purchases. You often get more value from points than from cash back.

How can someone decide whether a travel credit card is a good fit for them?

Rathner: You always want to make sure that the value you get out of a card each year exceeds the cost of holding onto it. From there, make sure the card’s other benefits are relevant to you — for example, a credit toward a CLEAR® Plus membership isn’t useful if your local airport doesn’t participate in the CLEAR® Plus program.

Rosa: I recommend looking at the welcome bonuses and also the rewards on non-travel-related purchases. Right now you might not be traveling much, but you want a card that’ll provide you with enough rewards on non-travel purchases so that you can take advantage once you resume traveling as usual.

Silbert: It’s all about how the card’s benefits and rewards align with your lifestyle. For example, if you spend a lot on dining, you should look for a card that offers bonus points on those purchases. For cards with annual fees, it’ll only be worth it if you actually take advantage of the premium benefits.

Additionally, make sure the points you’re earning are the best type of rewards for you. Chase Ultimate Rewards points are my personal favorite since I can redeem them for travel through Chase or with my favorite travel partners including Hyatt and United, and I can also redeem them for everyday purchases through Chase Pay Yourself Back.

Wilson: You need to ask some questions. Do you plan on using the points and miles you earn on your cards for travel? Are you hoping to use your welcome bonus for a specific redemption? Are you looking for a card that gives you luxury travel perks? Are you hoping to hit elite status with a certain hotel brand or airline? Are you a casual traveler or a frequent flyer? What spending categories will be most beneficial to you?

For example, if you want a card to help you hit elite status with United Airlines while giving you elite-like perks, then consider applying for a United credit card. Chase’s United co-branded cards give you perks such as lounge access, free checked bags, and priority boarding.

However, if you only fly occasionally or you’re not loyal to one airline, a flexible travel credit card that doesn’t offer perks on any one airline but earns points or miles that can be redeemed on a variety of airlines — like the Chase Sapphire Preferred — might be a better choice.

If you’re a road warrior who flies every week, you’ll want to think about a premium travel card that offers lots of perks to make your travels smoother, such as the Amex Platinum, which comes with airport lounge access and hotel elite status.

Is there anything else that you think is important to note when it comes to picking a travel credit card?

Rathner: Depending on how often you travel, you may get more value out of a cash-back credit card. A NerdWallet study found that travelers who spend more than $8,600 in travel per year, or take at least one international trip per year, get the most out of travel cards. If that doesn’t sound like you, there are other rewarding cards available.

Rosa: Don’t necessarily be afraid of the annual fee. Cards with annual fees can have enough perks to make them worth it.

Silbert: There are so many great travel credit cards available that it can be tempting to sign up for several and earn their welcome bonuses, but don’t bite off more than you can chew. Start slow with one rewards card, get a feel for its perks and rewards, and adjust your credit card strategy as needed if you want additional benefits or aren’t finding the annual fee to be worth it.